Florida SEC Whistleblower Attorneys

If you have original, timely, and significant information about securities violations, our firm has the experience you need to gain financial compensation for your efforts. Whether you believe you have knowledge of Ponzi schemes, market manipulation, insider trading, or any other violation that can lead to an SEC enforcement action, please contact us today. We represent SEC whistleblowers in Florida, across the nation, and internationally. Our experienced attorneys include a former SEC Enforcement Attorney who recognizes how the Commission examines securities violations and how to maximize the chances of the SEC Office of the Whistleblower investigating your tip, earning you the largest award.

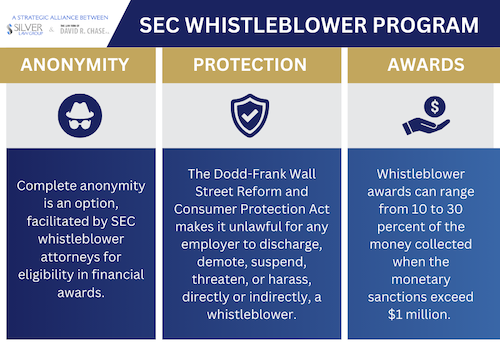

When the SEC uses your information to conduct a successful enforcement action over $1 million, they may award you 10 to 30 percent of the amount collected. However, only some tips are pursued, and there are strict eligibility rules. Therefore, retaining an experienced SEC whistleblower attorney is essential to support your chances of gaining compensation and protect your anonymity.

Top Florida SEC Whistleblower Law Firm

Top Florida SEC Whistleblower Law Firm With more chances to be awarded financial compensation, the SEC has received more tips leading to enforcement actions than ever before. Since 2020, the record amount awarded to SEC whistleblowers in a single case has been broken two times—first $114, then $279 million. In all, over $2 billion has been awarded to whistleblowers since the Commission adopted the program.

Recent changes to the SEC Whistleblower Program have increased the potential for financial awards. Florida whistleblowers will now be paid for information and assistance used in non-SEC actions, and the Commission may now consider the dollar amount of a potential award for increasing an award but not lowering it.

Awarding Florida WhistleblowersWhen the SEC’s successful enforcement actions exceed $1 million, Florida SEC whistleblowers can earn between 10 and 30 percent of the amount collected. Yet, there are stringent guidelines for eligibility, like those below:

- The information must be timely: The SEC has to receive tips before the Commission takes any action on a securities violation. All whistleblowers are required to come forward voluntarily.

- The information must be significant: Knowledge of SEC violations can lead to financial compensation, but the awards are based on the impact of the whistleblower’s information. The more helpful the account of the securities violations, the higher the potential SEC awards.

- The information must be original: The Commission needs your first-hand knowledge to pursue enforcement action for securities violations. The SEC doesn’t require whistleblowers to report internally first, but their award may be increased if they do.

If your information about Florida securities violations is timely, significant, and original, our SEC whistleblower attorneys stand ready to represent you. We’ll help you put together the information the Commission needs to substantiate violations so you can secure compensation.

Experienced Florida SEC Whistleblower AttorneysBecoming a Florida SEC whistleblower can be a risky undertaking: the SEC may not pursue your claim, and there are risks of employer retaliation. The Silver Law Group and the Law Firm of David R. Chase, Florida SEC whistleblower attorneys, can advise and represent you every step of the way, upholding your right to anonymity throughout the process.

Remain confident in coming forth with information on securities violations like the following:

- Accounting fraud at companies that are publicly traded

- Misconduct by stockbrokers and broker-dealers

- Commodities fraud, futures fraud

- EB-5 investment fraud

- FCPA violations or foreign bribery

- Fraud committed by hedge funds

- Internal reporting that is inadequate or non-compliant

- Insider trading

- Fraud committed by investment advisers

- Manipulations of the market

- Fraudulent or unregistered securities offerings

- Ponzi schemes

- Offerings of unregistered securities

The Silver Law Group and the Law Firm of David Chase have formed a strategic alliance to represent SEC whistleblowers like yourself. We’ve represented Florida whistleblowers for years in major metropolitan areas like Miami, Orlando, Tampa, Jacksonville, and everywhere in between. We have an SEC Enforcement lawyer on our team, bringing with him an exceptionally deep understanding of the SEC Whistleblower Program.

Contact Our Florida SEC Whistleblower AttorneysIf you’ve discovered violations of federal securities laws at your company, get in touch with our offices today. The team at the Silver Law Group and the Law Firm of David Chase know what the SEC needs to see to uncover violations—and they understand how Florida SEC whistleblowers can maximize their potential awards after successful enforcement actions.

For a free, confidential consultation with a top SEC whistleblower attorney and to become an SEC whistleblower in Florida, contact the Silver Law Group and the Law Firm of David Chase by email or call us today at (800) 975-4345.

Silver Law Group Home

Silver Law Group Home